- Thesis Driven

- Posts

- The Thesis Driven TL;DR | Week of February 16th

The Thesis Driven TL;DR | Week of February 16th

Everything you need to know about real estate in one little email

🛎️ NYC’s Waldorf Astoria Expected to Hit Market for $1B+

🏘️ Institutional capital keeps flooding UK rental housing

🏢 Brookfield doubles down on European rental housing

🔧 Upcoming Workshops: AI in Underwriting, How to Build and Fund Data Centers

📚 Upcoming Courses: Selling into Real Estate Owners, Capital Raising

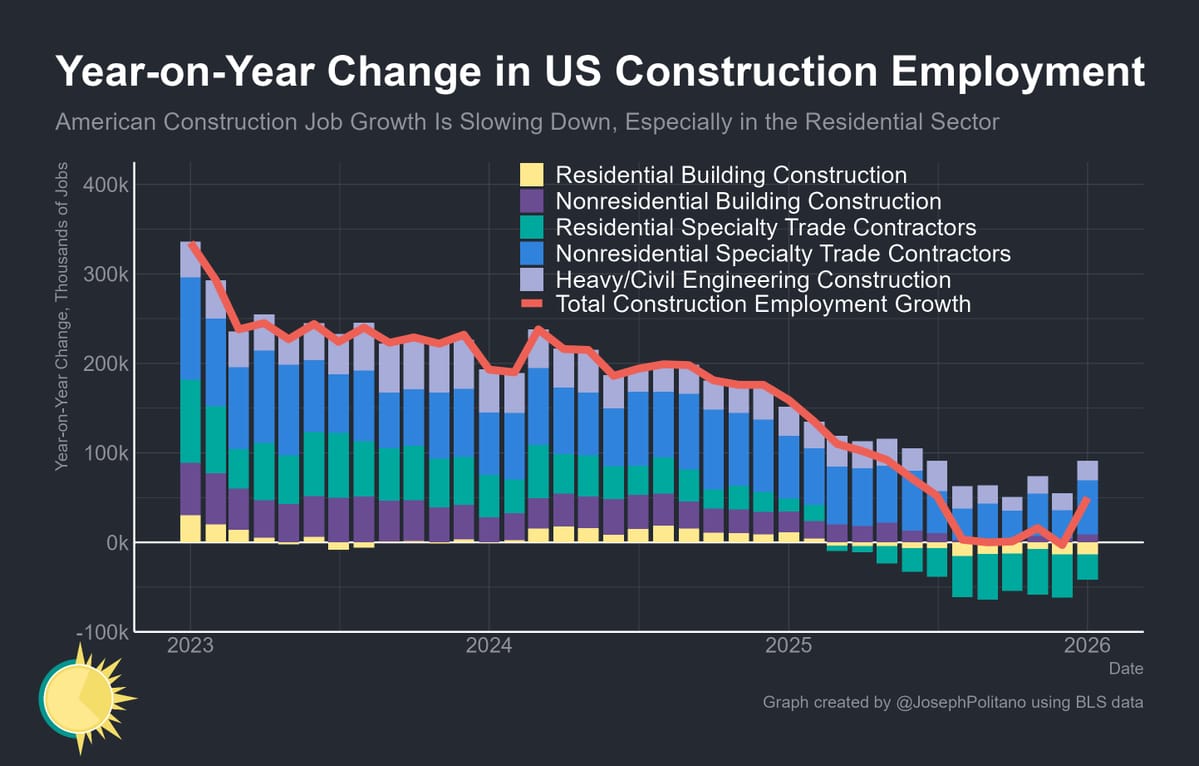

Data Viz of the Week: Construction Employment Ticks Up

After several months of stagnation, year-over-year construction employment ticked up in January with 33,000 new jobs. But residential construction continues to drag on jobs numbers, largely offsetting a rise in non-residential construction employment.

In other words, developers hoping for a significant decrease in construction costs are likely to be disappointed as data center and infrastructure projects absorb labor demand.

Upcoming Thesis Driven Courses & Workshops

📣 LAST CALL - February 20: Workshop: AI in Underwriting (💻 Online): A two-hour workshop for investors, developers, lenders, and operators exploring how AI is being applied to real estate underwriting—from deal screening to IC memos.- $299

February 26-27: Workshop: How to Build and Fund Data Centers (💻 Online): A two-day interactive workshop designed for real estate investors, developers, and capital allocators who want to understand—and invest in—the data center asset class - $499

March 4-5: Workshop: Building the Zero-Employee Property Manager (💻 Online): A two-day interactive workshop for owners, operators, and asset managers exploring how close we really are to running multifamily properties with little—or no—full-time staff - $499

March 10: Course: Selling into Real Estate Owners (💻 Online): A five-week bootcamp for people selling technology and products into the real estate industry to level up their sales game and build stronger relationships with buyers in the ecosystem - $1,299

March 4-5: Workshop: Building the Zero-Employee Property Manager (💻 Online): A two-day interactive workshop for owners, operators, and asset managers exploring how close we really are to running multifamily properties with little—or no—full-time staff - $499

March 11: Workshop: LinkedIn Strategy for GPs (💻 Online):A live, practical workshop for real estate GPs, operators, and fund managers who want to use LinkedIn intentionally—as a capital formation tool, not a vanity channel - $299

March 16: Course: Fundamentals of Capital Raising (💻 Online): A five-week bootcamp for raising capital for real estate projects from individuals, family offices and institutional investors - $1,299

Three Articles We Loved from Last Week

It’s not easy keeping up with everything. Here are three articles we loved from the past week that you may have missed:

(The Real Deal) NYC’s Waldorf Astoria Expected to Hit Market for $1B+

China’s Dajia Insurance is preparing to market the redeveloped Waldorf Astoria in Manhattan for more than $1 billion. The offering includes the newly repositioned 375-room hotel plus retail and restaurant components, following an eight-year redevelopment that also added 372 condo units (sold separately). The listing signals renewed liquidity testing for trophy hospitality assets as cross-border capital re-engages prime U.S. real estate.

(Financial Times) Greystar Nears £500M London Build-to-Rent Acquisition

Greystar is close to acquiring roughly 900 build-to-rent units in London’s Elephant Park development for ~£500 million, in what would be one of the UK sector’s largest transactions this year. The portfolio includes studio through three-bedroom units with full amenity offerings, acquired from CPPIB and Lendlease. Institutional conviction in BTR continues to strengthen as supply remains constrained and rental demand accelerates, with sector investment hitting record levels in 2025.

(Reuters) Brookfield in Talks to Acquire Blackstone’s Spanish Rental Platform Fidere

Brookfield Asset Management is reportedly in exclusive negotiations to acquire Fidere, Blackstone’s Spanish residential rental platform, in a deal valued around €1 billion ($1.2B). The portfolio spans roughly 5,300 units across 47 buildings concentrated in Madrid, plus additional assets in Guadalajara. If completed, the transaction would rank among Spain’s largest residential trades in recent years and underscores continued institutional appetite for scaled European rental housing despite broader capital markets volatility.

Developer of the Week: Machine Investment Group

Can new owners turn around a troubled Silicon Valley condo project?

Machine Investment Group has embarked on a $30 million renovation of 188 West Saint James, a 640-unit dual-tower residential complex near San Pedro Square in San Jose, just months after acquiring the property alongside Centurion Real Estate Partners.

The project was previously plagued with delays, lawsuits, and delinquencies, and for a time pivoted from sales to rentals.

The MIG-led upgrade focused on repositioning the asset with a redesigned lobby, new resident lounge, meeting spaces, and a refreshed pool deck, with design led by Steinberg Hart. Units range from studios to penthouses, with pricing from roughly $425,000 to $1.88 million, as sales continue through Polaris Pacific.

You can read more about Machine Investment Group on the Thesis Driven GP database here.

Know about a developer doing something cool? Reach out to [email protected] with the tip!

188 West Saint James in San Jose, CA

Investor of the Week: GTIS Partners

GTIS Partners is a global real assets investment firm focused on development and value-add strategies across residential and industrial platforms throughout the Americas. Headquartered in New York with additional offices across the U.S., Europe, and Brazil, the firm manages approximately $4.3 billion in gross AUM and operates through a localized investment model supported by in-house investment, development, asset management, and capital markets capabilities. GTIS targets high-growth markets underpinned by strong job formation, income expansion, and demographic tailwinds, deploying capital both directly and alongside experienced operating partners.

Within real estate, GTIS has built a scaled residential platform spanning multifamily, homebuilding, land and master-planned communities, urban infill development, and single-family rental. The firm’s multifamily strategy focuses on ground-up development and value-add opportunities in submarkets near employment hubs and lifestyle amenities. Its footprint includes 30 assets totaling ~11,225 units with ~$4.9B in total project cost, while the broader U.S. residential platform reflects approximately $2.6B of equity committed across 150+ assets and 64,000+ units. Alongside housing, GTIS is expanding its industrial and logistics platform, now valued around $1B, executing development projects with partners such as AXIAL Commerce Station in North Carolina. The firm’s approach blends direct investment with partner-led execution, leveraging localized teams to source, develop, and operate assets aligned with long-term demographic and supply-demand fundamentals.

Get more details on GTIS Partners, including team contacts, deal activity, and investment preferences, inside the CapitalStack database.

—Brad and Paul