- Thesis Driven

- Posts

- The Thesis Driven TL;DR | Week of January 12th

The Thesis Driven TL;DR | Week of January 12th

Everything you need to know about real estate in one little email

📉 Trump’s housing policy shake-up sends SFR stocks tumbling

🏛️ D.C. leads the office-to-residential boom

💰 Billionaires’ Row gets steeper

🔧 Upcoming Workshops: Family Office Fundraising, AI in Architecture & Construction

📚 Upcoming Courses: Selling into CRE, Capital Raising

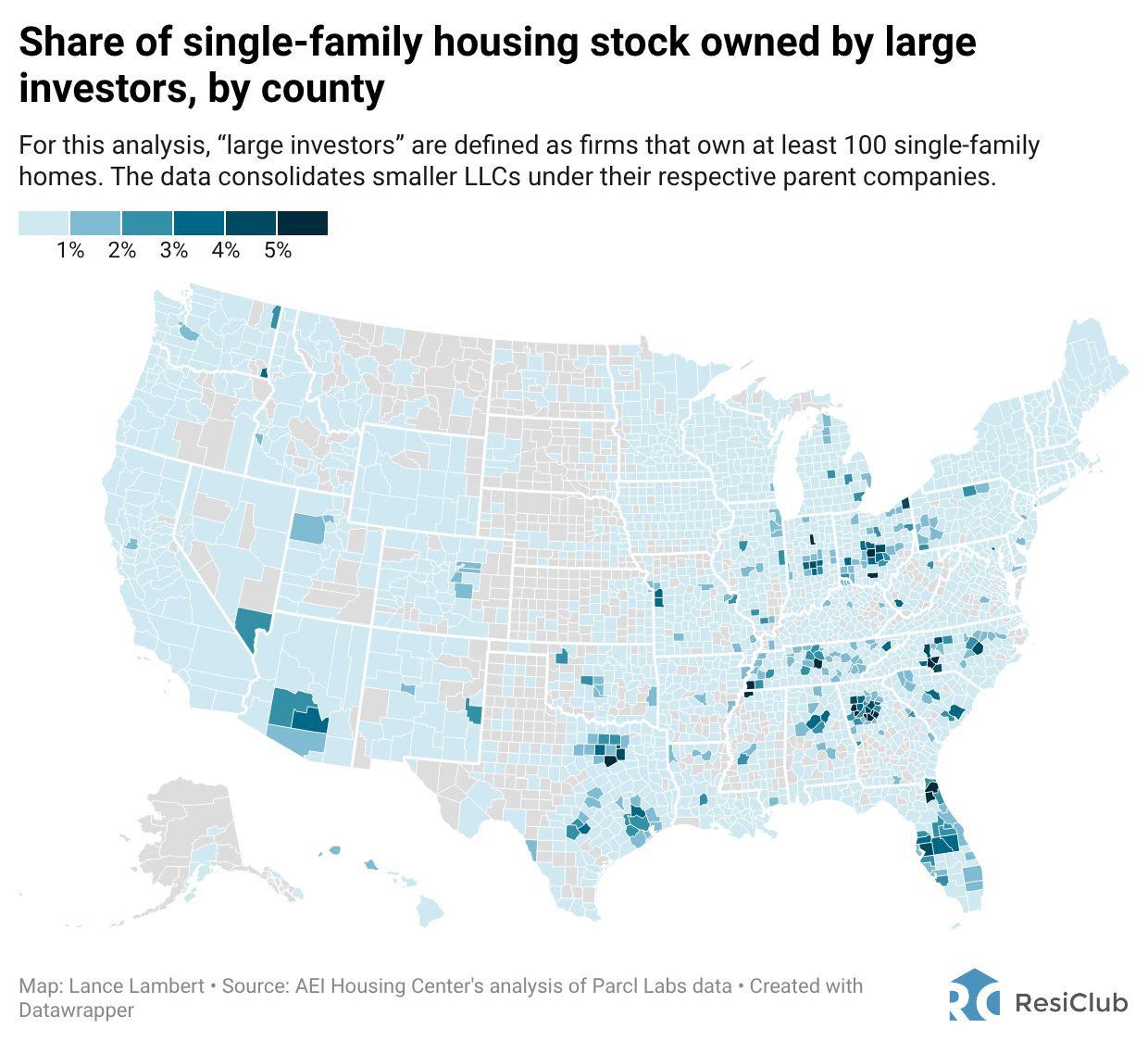

Data Viz of the Week: Institutional SFR Markets

Last week, the Trump Administration stated its aim to ban institutional ownership of single family homes. As we consider the impact, it’s worth noting that single family ownership is hardly evenly distributed; institutional SFR investors tend to favor some markets while ignoring others entirely.

Phoenix, Dallas, Columbus, Atlanta, and Charlotte are a handful of the markets that will be most impacted by an institutional SFR ban. West Coast cities and the Northeast, on the other hand, have almost no institutional SFR presence.

Upcoming Thesis Driven Courses & Workshops

📣 LAST CALL - January 12th: 5-Week Course: Master Selling into Real Estate Owners (💻 Online): A 5-week bootcamp for people selling technology and products into the real estate industry - $1,299

📣 LAST CALL - January 14-15: Workshop: Raising Capital from Family Office (💻 Online): A two-day interactive workshop designed for real estate sponsors, entrepreneurs, and capital raisers looking to raise capital from family offices - $499

January 22: Workshop: AI in Architecture, Engineering, and Construction (AEC) Workshop (💻 Online): An interactive workshop for owners, operators, developers, architects, and builders exploring how AI is reshaping the AEC stack—from design to delivery - $499

January 26: 5-Week Course: Fundamentals of Capital Raising (💻 Online): A 5-week bootcamp providing an insider’s guide to raising capital for real estate projects from individuals, family offices and institutional investors - $1,299

Three Articles We Loved from Last Week

It’s not easy keeping up with everything. Here are three articles we loved from the past week that you may have missed:

(Barron’s) Trump Wants to Ban Big Investors from Buying Single-Family Homes

President Donald Trump announced he will seek to ban large institutional investors from purchasing single-family homes, framing it as a move to improve housing affordability and “restore the American Dream.” The declaration shared on Truth Social spooked markets: shares of major real estate players like Blackstone, Invitation Homes and American Homes 4 Rent all fell sharply on the news. Institutional ownership currently represents a small share of the overall housing stock, but the political pressure could reshape investor behavior and valuations in the SFR space.

(NY Post) NYC Co-op Residents Hit With 450% Rent Hike After Court Ruling

A New York County Supreme Court judge upheld a 450% ground-rent increase at the Carnegie House co-op on Manhattan’s Billionaires’ Row, sending monthly costs for residents dramatically higher. The decision, tied to a lease recalculation based on booming land values controlled by wealthy investors, could plunge some residents into financial distress and trigger discounts in unit values. Critics argue the ruling highlights deep affordability issues in the ultra-prime NYC market.

(WSJ) Washington, D.C. Emerges as Hotbed for Office-to-Housing Conversions

Washington, D.C. is seeing a surge in adaptive reuse of outdated office buildings into residential units, with more than 6,500 homes in the pipeline—second only to New York City. Developers are capitalizing on high vacancy rates and supportive local policies (including tax incentives and relaxed zoning) to convert old office stock into modern apartments. A marquee project by Post Brothers—a $750 million conversion of two Connecticut Avenue buildings into 530 apartments—is expected to break ground soon, reflecting intensifying interest from investors in transforming silos of obsolete office space into much-needed housing.

Developer of the Week: Wiseman Residential

Wiseman Residential is advancing another multifamily project in Los Angeles.

The firm is constructing a six-story, 119-unit apartment building at 11261 W. Santa Monica Boulevard in Sawtelle, adjacent to the 405 Freeway. The project includes 147 parking spaces and a mix of studio through three-bedroom units.

Using Transit Oriented Communities incentives, Wiseman increased the project’s allowable density and will reserve 17 units for very low-income households. Designed by Uriu & Associates, the building will feature a rooftop deck, gym, and outdoor patios. Wiseman recently completed a similar project nearby, reflecting its steady infill strategy across West LA.

You can read more about Wiseman on the Thesis Driven GP database here.

Know about a developer doing something cool? Reach out to [email protected] with the tip!

Rendering of Wiseman’s latest project at 11261 W Santa Monica Blvd

Investor of the Week: Wafra

Wafra is a global investment manager with a significant real estate platform, focused on value-add and opportunistic strategies across traditional and alternative real assets. Backed by long-term Middle Eastern (Kuwaiti) capital, the firm targets situations where complexity, thematic tailwinds, or capital-structure creativity can drive attractive risk-adjusted returns, and partners with best-in-class operators and managers across the U.S. and Europe.

Within real estate, Wafra is particularly active in alternative and niche property types—including marinas, small-bay industrial, self-storage, data centers, life sciences, senior housing, and specialized hospitality—alongside selective exposure to transitional office, retail, and housing. The firm invests through a mix of LP commitments, co-investments, joint ventures, and structured equity or preferred positions, with a thesis-driven approach that emphasizes alignment, durable cash flows, and operational value creation rather than passive ownership.

Get more details on Wafra, including team contacts, deal activity, and investment preferences, inside the CapitalStack database.

—Brad and Paul