- Thesis Driven

- Posts

- The Thesis Driven TL;DR | Week of July 21st

The Thesis Driven TL;DR | Week of July 21st

Everything you need to know about real estate in one little email

🥶 Tariffs fueling interest rate freeze (Reuters)

📦 Prologis is doubling down on build-to-suit warehouses (WSJ)

🎰 SL Green raises $1B betting on NYC office’s turnaround (The Real Deal)

📚 Upcoming courses for AI & Selling into Real Estate

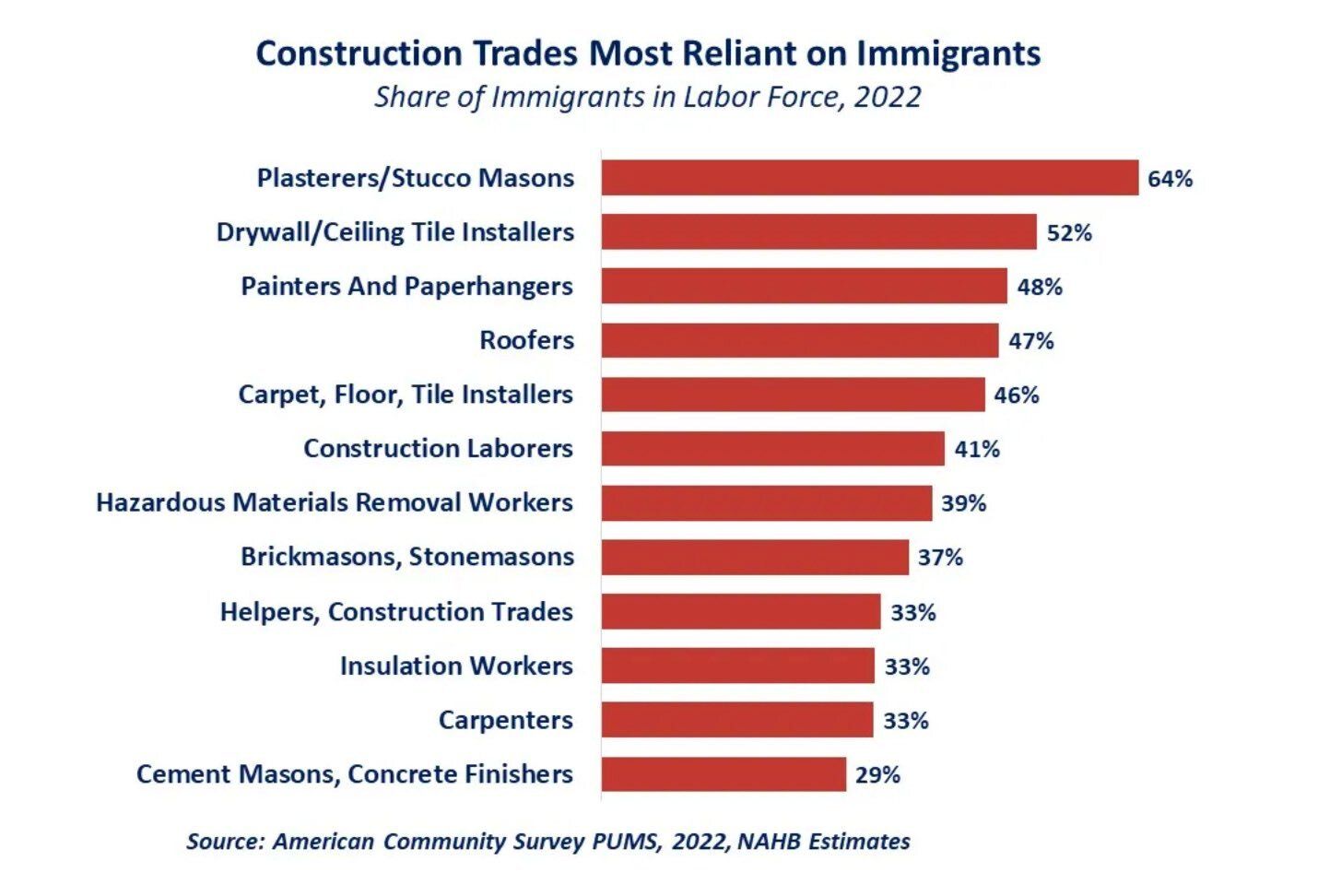

Data Viz of the Week: At-Risk Construction Trades

Anyone who has developed real estate knows that construction is heavily dependent on immigrant labor. But which trades are most vulnerable to the immigration policy shifts in motion today?

According to NAHB estimates, plasterers, drywall installers, and painters are the most vulnerable, with roofers and carpet/floor/tile installers right behind them.

The least vulnerable? Concrete masons and finishers as well as carpenters.

Upcoming Thesis Driven Courses & Classes

July 28: Selling Into Real Estate Owners (💻 Online): A bootcamp for people selling technology and products into the real estate industry - Sign up

July 29-30: Workshop: AI in Real Estate (💻 Online): A two-day interactive workshop for real estate owners, operators, and developers exploring how to use AI in the sector - Sign up

Three Articles We Loved from Last Week

It’s not easy keeping up with everything. Here are three articles we loved from the past week that you may have missed:

(Reuters) Analysts react to increase of US consumer prices in June

June’s 0.3% CPI rise—the fastest since January—suggests inflation, especially tariff-driven, remains sticky. That keeps the Fed on hold and puts continued pressure on CRE financing costs and investment yields.

(WSJ) Prologis Ramps Up Plans for New Warehouse Construction

Prologis is nearly tripling its Q2 warehouse development to over $900 million, 65% pre-leased—a major bet on tenant-driven demand amid rising speculative vacancy rates (currently 7.1%).

(The Real Deal) SL Green Surpasses $1B for Property Debt Fund

Manhattan’s biggest office landlord launched an opportunistic debt fund, raising over $500 million this week alone—now totaling $1 billion to refinance and manage high-yield NYC office loans and CMBS holdings.

Developer of the Week: JBG Smith

DC-area giant JBG Smith just pulled down a massive distressed office deal, bringing home a 3-building, 500,000 square foot Northern Virginia complex.

Smith plans to convert at least one of the buildings to residential, something the firm has experience with - they also own the old WeLive office conversion in Crystal City.

You can read more about JBG Smith on the Thesis Driven GP database here.

Tyson Dulles Plaza

Know about a developer doing something cool? Reach out to [email protected] with the tip!

—Brad and Paul