- Thesis Driven

- Posts

- The Thesis Driven TL;DR | Week of March 17th

The Thesis Driven TL;DR | Week of March 17th

Everything you need to know about real estate in one little email

🏗️ Rising material costs are squeezing U.S. builders

🇲🇽 Mexico’s commercial real estate market is on the rise

💰 Wells Fargo sues JPMorgan over CRE loan

📚 Courses on capital raising, selling into CRE, LP investing & more

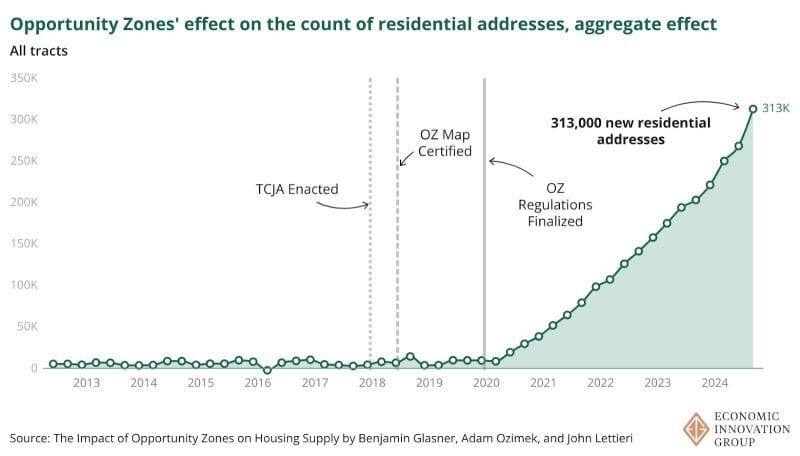

Data Viz of the Week: Opportunity Zones Work

New data from the Economic Innovation Group indicates that Opportunity Zones are a powerful lever for building more housing. Since inception, the OZ program has created more than 313,000 new residential units at an average subsidy of $26K per unit--with the majority of those units in economically disadvantaged communities.

Why did it work so well? Economist Jay Parsons writes that the OZ program’s success is due to it being "by right" and without any special bureaucratic approval process—and it also avoids giving cities a veto right over OZ projects.

Upcoming Thesis Driven Courses & Classes

Sharpen your real estate IQ on capital raising, selling into real estate owners, developing local real estate projects, and more.

All Upcoming Courses

March 17: Fundamentals of CRE (💻 Online): A bootcamp providing an insider’s view of “a day in the life” of key industry stakeholders, with real-world insights and applications - Sign up

March 18 & 19: Fundamentals of Capital Raising (🗽Live in NYC): Insider’s guide to raising capital for real estate projects & platforms–from individuals, family offices and institutional investors - Sign up

March 31: Selling Into Real Estate Owners (💻 Online): A bootcamp for people selling technology and products into the real estate industry - Sign up

March 31: Fundamentals of Capital Raising (💻 Online): Insider’s guide to raising capital for real estate projects & platforms–from individuals, family offices and institutional investors - Sign up

April 7: Introduction to Development (💻 Online): A first-person POV simulation for aspiring developers to learn to source, underwrite and finance a local real estate project - Sign up

Three Articles We Loved from Last Week

It’s not easy keeping up with everything. Here are three articles we loved from the past week that you may have missed:

(Business Insider) Trump’s tariffs are starting to bite American builders

President Trump’s tariffs on foreign steel, aluminum, and other building materials have led to substantial cost increases for American builders and developers. Essential construction components have seen price hikes, with some projects experiencing budget increases of up to $2 million. This escalation is hindering new construction projects and diminishing forecasted returns, prompting many developers and contractors to adopt a more conservative approach, delaying projects in hopes of tariff reversals. The uncertainty surrounding future tariff changes further exacerbates challenges in the construction and real estate sectors.

(OpenPR) Latest Market Segmentation in the Mexico Commercial Real Estate Market: An In-Depth Look

The Mexico Commercial Real Estate Market, valued at approximately USD 15.7 billion in 2022, is projected to grow at a CAGR of 6.5% from 2023 to 2028. This expansion is driven by increasing demand for office spaces, industrial warehouses, and retail establishments. Economic growth, urbanization, and infrastructure investments are fueling this robust growth. The retail sector is evolving with the rise of e-commerce and changing consumer preferences, creating new opportunities in commercial space leasing. Major cities like Mexico City, Guadalajara, and Monterrey are leading in demand, with a growing interest in sustainable and green buildings adding to the market’s potential.

(Reuters) Wells Fargo sues JPMorgan over troubled $481 million real estate loan

Wells Fargo has initiated a lawsuit against JPMorgan Chase to recover investor losses linked to a $481 million commercial real estate loan. The loan, issued in 2019 to finance the Chetrit Group’s acquisition of 43 multifamily properties across ten U.S. states, is alleged to have been based on inflated financial metrics. Wells Fargo, acting as trustee for the investors, claims that both JPMorgan and Chetrit were aware that the properties’ net operating income had been overstated by 25% prior to closing. Despite this knowledge, JPMorgan proceeded with the loan, which was later sold to investors who were unaware of the discrepancies. Following a default in 2022, the outstanding debt now exceeds $285 million, leading to significant investor losses. Wells Fargo is seeking for JPMorgan to repurchase the loan or compensate for breach of contract.

Developer of the Week: Chess Builders

One of New Jersey’s largest real estate projects in years is taking shape: the Iberia, which will feature more than 1,400 apartment units across four towers in downtown Newark. Approved last month, the $800 million project is expected to deliver in 2029.

Check out Chess Builders on the Developer Database to learn more.

A rendering of the street level of the 1,400-unit Iberia in Newark, NJ

Know about a developer doing something cool that we should feature? Reach out to [email protected] with the tip!

—Brad and Paul