- Thesis Driven

- Posts

- The Thesis Driven TL;DR | Week of November 10th

The Thesis Driven TL;DR | Week of November 10th

Everything you need to know about real estate in one little email

📉 Blackstone’s senior-housing bet turns ugly

🌴 Neom’s $8TN The Line project stalled in Saudi Arabia

🔬 Life-science real estate’s run ends abruptly

📚 Workshops & courses: OpCo-PropCo Structuring, Real Estate Finance 101, & AI

Shout to The Real Estate Haystack!

Our friends at The Real Estate Haystack newsletter provide research-based insights for sophisticated real estate investors. Published by two investment veterans, every week they scour academic research that no one reads, identify the findings that will help investors create value, and distill them into actionable insights delivered with a little dose of humor. And the price is right – the Haystack is free (for now, they tell us).

A recent Haystack explored inefficiencies in how landlords set office rents. If a specific tenant size is abundant in an MSA — meaning it represents a high share of all available spaces in a market — that size tends to earn significantly higher rents in what researchers called an “Abundance Premium.” Another recent issue examined an accurate and surprisingly simple way to forecast cap rates, a critically important underwriting assumption that’s typically just a guess.

These valuable (and sometimes counter-intuitive) research-based findings are the Haystack’s bread and butter, which is why we read it every week.

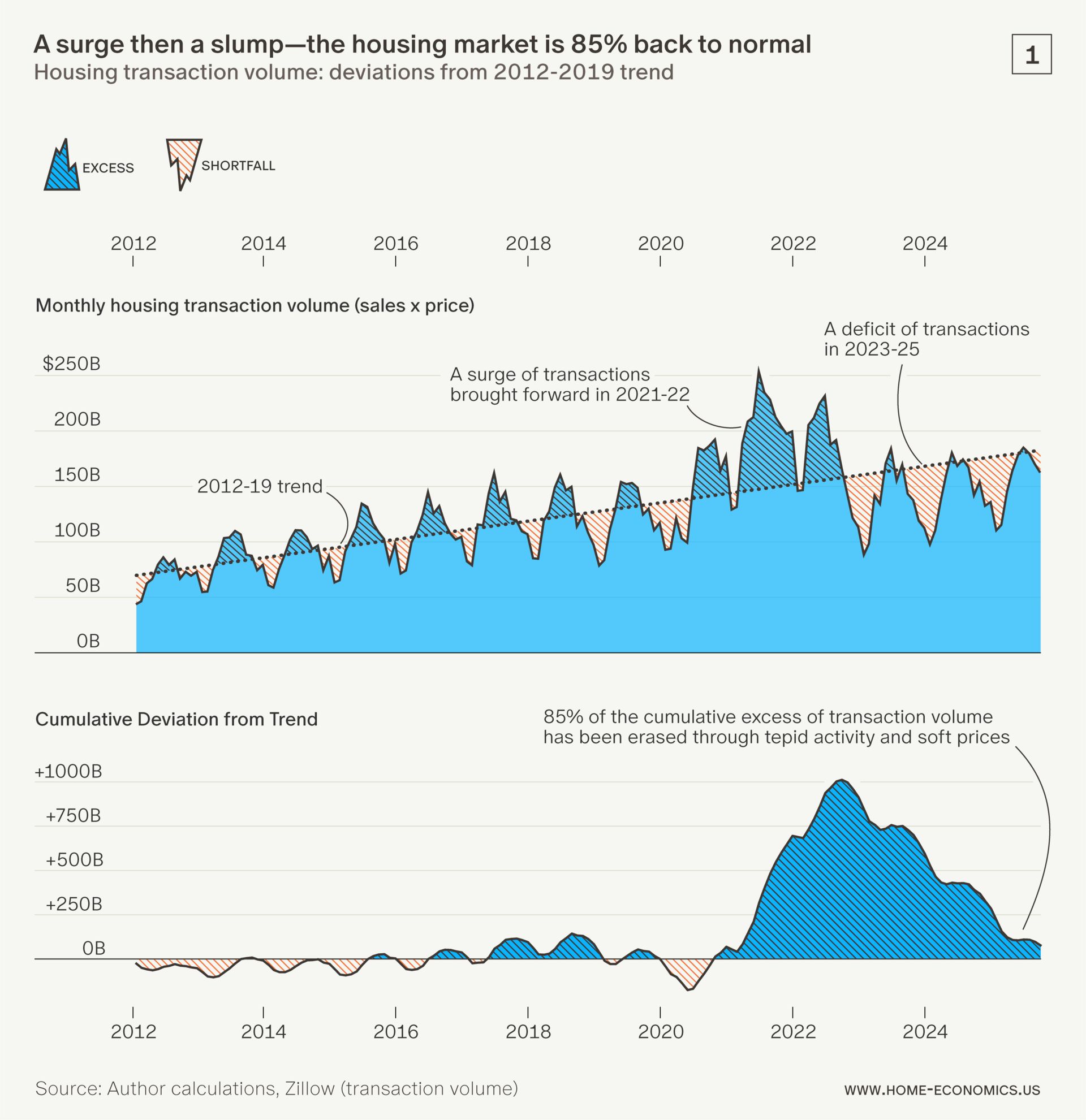

Data Viz of the Week: A Return to Normal?

The housing market is almost done digesting the flood of 2020-22 transactions, with recent analysis from Home Economics showing cumulative volume approaching a return to the 2012-19 trendline.

Of course, transaction volume is driven by many factors - population growth, household formation, and interest rates, to name a few - and it's entirely possible for cumulative volume to sit below the trendline for an extended period of time. But pressure appears to be building for a return to higher transaction volumes.

Upcoming Thesis Driven Courses & Classes

November 18-19: Workshop: Structuring an OpCo/PropCo Business Workshop (💻 Online): A two-day interactive workshop designed for real estate operators, entrepreneurs, and investors looking to structure or invest in OpCo/PropCo platforms - Sign up

December 9-10: Workshop: AI in Real Estate (💻 Online): A two-day interactive workshop for owners, operators, and developers exploring how to use AI in the real estate sector - Sign up

December 16-17: Workshop: Real Estate Finance 101 (💻 Online): A two-day interactive workshop designed for founders, operators, and professionals who want to finally understand how real estate finance actually works—and learn to speak the language of developers, investors, and property owners. - Sign up

Three Articles We Loved from Last Week

It’s not easy keeping up with everything. Here are three articles we loved from the past week that you may have missed:

(WSJ) Blackstone Is Offloading a Flopped $1.8 B Investment in Senior Housing

Blackstone is quietly liquidating its $1.8 billion senior-housing portfolio after racking up more than $600 million in losses. The firm bought around 90 facilities from 2016-17, hoping to apply its “buy it, fix it, sell it” model, but the business proved far more complex. Plunging occupancy, surging labor and healthcare costs, heavy regulatory pressure and floating-rate debt on the acquisitions throttled returns. While the broader senior-housing market is starting to rebound, most of these properties were middle-market assets—harder hit than top-tier ones—and Blackstone has already sold roughly 70 buildings, many at discounts exceeding 70%.

(The Real Deal) Neom’s $8TN The Line project stalled in Saudi Arabia

Saudi Arabia’s ambitious mega-city vision, The Line — a 106-mile, car-free vertical city slicing through desert to sea—is now facing serious headwinds. After years of lofty promises, soaring costs, construction delays and a shortfall of foreign investment have prompted a dramatic scale-down. What began as a $1.6 trillion project has grown to estimates near $8.8 trillion, with only three out of an original 20 modules still under development. While the project remains tagged as a “strategic priority,” insiders say the financial and geographic feasibility is under intense scrutiny.

Once a red-hot segment, U.S. life-sciences real-estate—especially lab/R&D space in major hubs like Boston, San Francisco and San Diego—is now seeing a dramatic slowdown. Vacancy rates nationally have surged from ~6.6% in 2022 to ~27% in 2025, driven by a collapse in VC funding, federal research delays and oversupply. Developers who bet big on the boom are now putting projects up for sale or redirecting assets.

Developer of the Week: The Abraham Companies

More multifamily is breaking ground in Beverly Grove, LA.

Site work has begun at 400 S. San Vicente Boulevard, where The Abraham Companies is developing an eight-story mixed-use project on a 0.77-acre Beverly Grove site formerly occupied by a strip mall. The development will include 126 apartments, 11,600 square feet of ground-floor retail, and a three-level, 153-space underground garage.

Designed by Steinberg Hart, the building will feature 6,200 square feet of amenities, including a pool deck, spa, lounge, and fitness center. Construction is expected to take about 26 months.

The site lies across from a Caruso-entitled property now for sale and near other planned developments along San Vicente, including a medical office project at Wilshire Boulevard and an expansion of the Cedars-Sinai campus.

You can read more about The Abraham Companies on the Thesis Driven GP database here.

Know about a developer doing something cool? Reach out to [email protected] with the tip!

Rendering of the future 400 S San Vicente in Los Angeles

Investor of the Week: CenterSquare

CenterSquare Investment Management is a Philadelphia-area real assets manager with more than three decades of experience investing across public and private real estate and real estate debt markets. Headquartered in Plymouth Meeting, Pennsylvania—with offices in New York, Los Angeles, London, and Singapore—the firm manages capital for institutions and private clients through listed real estate, private equity, and private debt strategies.

Founded in 1987, CenterSquare has built a reputation for disciplined, research-driven investing that bridges public and private markets. The firm’s core focus areas include rental housing, industrial, essential service retail, and value-added private real estate strategies—sectors it believes are poised to outperform amid a global valuation reset. CenterSquare’s investment team is positioning to capitalize on the widening disconnect between public and private valuations, targeting opportunities to acquire assets at meaningful discounts to replacement cost.

Recently, the firm announced a $100 million co-investment vehicle with Temasek, Singapore’s sovereign wealth fund, aimed at private real estate debt and structured capital opportunities. This move reflects CenterSquare’s broader push into flexible credit solutions and high-conviction investments across the capital stack.

With more than 150 institutional relationships averaging $85 million in size, CenterSquare serves as a trusted partner for investors seeking a balanced mix of liquidity, yield, and growth. As markets adjust to a higher-rate environment, the firm is focusing on real estate credit, value-added platforms in growth markets, and public/private arbitrage plays where it believes valuations are mispriced and liquidity can create an edge.

Get more details on CenterSquare Investment Management, including executive contacts, deal activity, and investment preferences, on the CapitalStack database.

—Brad and Paul