- Thesis Driven

- Posts

- The Thesis Driven TL;DR | Week of November 17th

The Thesis Driven TL;DR | Week of November 17th

Everything you need to know about real estate in one little email

🔥 Luxury lodging is on fire

🏢 Teen-built web tool takes on NYC’s hidden rent-stabilized market

📈 CRE investment surges to $112B in Q3 2025

📚 Workshops & courses: OpCo-PropCo Structuring, Real Estate Finance 101, & AI

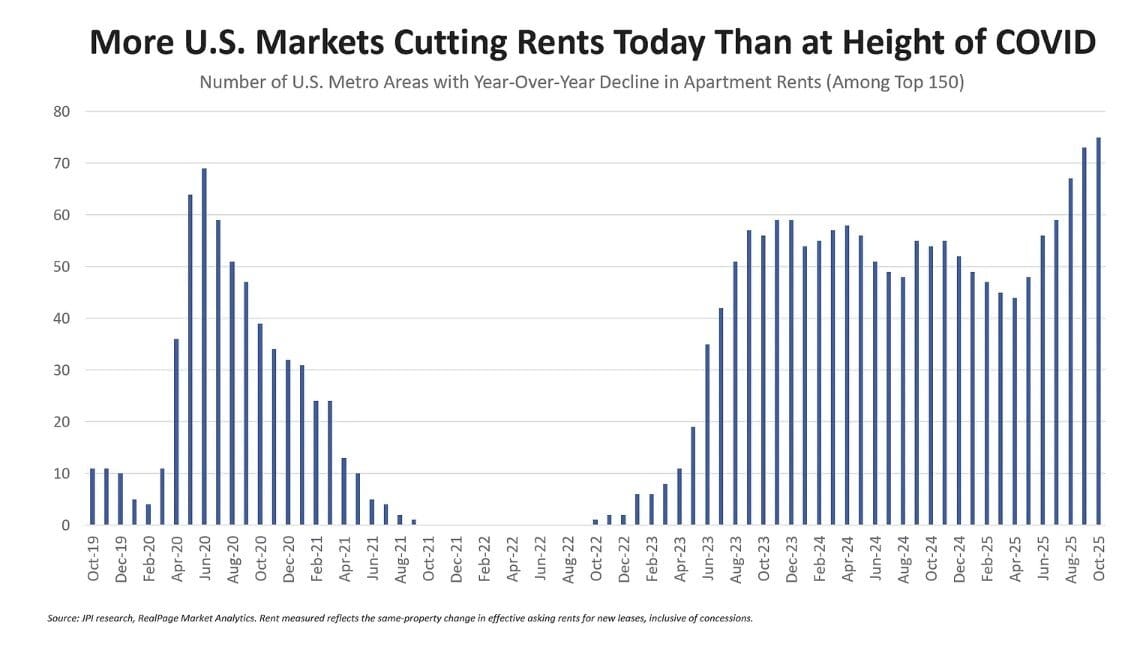

Data Viz of the Week: Rents Falling in Half of US Metros

The past two years have seen historic levels of apartment deliveries in many markets, and rents are responding predictably, now falling in half of the US’s top 150 metro areas.

This means that more cities are now seeing declining rents than at the peak of the COVID pandemic. With apartment deliveries continuing apace into next year - and growing demographic headwinds - a rebound may take longer than multifamily operators would like.

Upcoming Thesis Driven Courses & Classes

📣 LAST CALL November 18-19: Workshop: Structuring an OpCo/PropCo Business Workshop (💻 Online): A two-day interactive workshop designed for real estate operators, entrepreneurs, and investors looking to structure or invest in OpCo/PropCo platforms - Sign up

December 9-10: Workshop: AI in Real Estate (💻 Online): A two-day interactive workshop for owners, operators, and developers exploring how to use AI in the real estate sector - Sign up

December 16-17: Workshop: Real Estate Finance 101 (💻 Online): A two-day interactive workshop designed for founders, operators, and professionals who want to finally understand how real estate finance actually works—and learn to speak the language of developers, investors, and property owners. - Sign up

Three Articles We Loved from Last Week

It’s not easy keeping up with everything. Here are three articles we loved from the past week that you may have missed:

(WSJ) Wealthy Travelers Are Splurging on Luxury Hotels Like Never Before

Affluent Americans are powering a record boom in luxury hotels, with average nightly rates hitting $394—a massive $168 premium over the next tier. Bookings at upscale resorts and marquee urban hotels are rising despite broader economic softness. Brands like Montage and Corinthia are expanding rapidly, charging $2,000+ per night for high-end suites as multigenerational travel and wealthy households drive demand.

(NYT) Affordability site helps renters find rent-stabilized housing

Two high-school students launched a free online portal that cross-references countless rental listings with New York City’s official rent-stabilized building data. The tool alerts users in real-time about newly available units, helping renters locate true stabilized apartments amid a tight, opaque market. Early users say it’s saved them thousands of dollars and drastically cut search time. The duo now aims to expand the platform’s coverage and functionality as an increasing number of landlords and listings avoid or mislabel stabilized units.

CRE Investment Surges to $112B in Q3 2025

U.S. commercial real estate investment rose ~13% YoY in Q3 to about $112 billion, led by private buyers and improved lending. Multifamily was the dominant asset class, while office and retail showed the strongest growth rates.

Developer of the Week: JPI

Texas-based developer JPI secured a $150 million construction loan to build Portico, a 272-unit mixed-use project in Downtown Long Beach, California. The development at 450 The Promenade North will include studios through three-bedrooms, 18,841 square feet of ground-floor retail, and 16 deed-restricted affordable units. JPI is partnering with Tokyo Tatemono US Ltd. and BMO Bank.

Renderings show a contemporary podium building with a brick exterior, rooftop deck, sports simulator, and pool deck. Portico is expected to deliver in 2028.

The broader City Place site is planned for 628 additional units across several eight-story buildings designed by MVE + Partners, while AC Martin will design Portico. JPI continues to advance other transit-oriented projects across Southern California.

You can read more about JPI on the Thesis Driven GP database here.

Know about a developer doing something cool? Reach out to [email protected] with the tip!

Rendering of JPI’s Portico development in Long Beach

Investor of the Week: Alea Global Group

Alea Global Group is a family-owned investment firm headquartered in Kuwait with a growing international presence across London, Dubai, and Toronto. Over the past decade, the firm has evolved into a global allocator and multi-asset investor, deploying capital across private equity, venture capital, real estate, and alternative investments on behalf of the Alea family and its network of co-investors.

Founded by the Al Duaij family, the firm blends strategic capital with deep cross-border networks, hosting high-profile global investment summits that connect institutional allocators, family offices, and emerging managers across Europe, the Middle East, Asia, and North America.

Alea’s real estate activity spans value-add and opportunistic projects, including residential, logistics, and mixed-use developments in both established and growth markets. Its investment philosophy emphasizes diversification, disciplined underwriting, and global reach—leveraging Alea’s network to identify differentiated opportunities across sectors and geographies.

With a flexible mandate and an appetite for long-term partnerships, Alea Global Group represents a sophisticated family office investor seeking opportunities across private markets, real assets, and cross-border co-investments—particularly where strong operators, clear value-creation plans, and alignment matter most.

Get more details on Alea Global Group, including executive contacts, deal activity, and investment preferences, on the CapitalStack database.

—Brad and Paul