- Thesis Driven

- Posts

- The Thesis Driven TL;DR | Week of October 13th

The Thesis Driven TL;DR | Week of October 13th

Everything you need to know about real estate in one little email

📉 NYC loan default ripples nationally

🫣 Condo supply overwhelms demand

⚡️ Rate cuts on deck.. CRE waiting for its jolt

📚 Workshops & courses: Retail capital raising (new, last call)

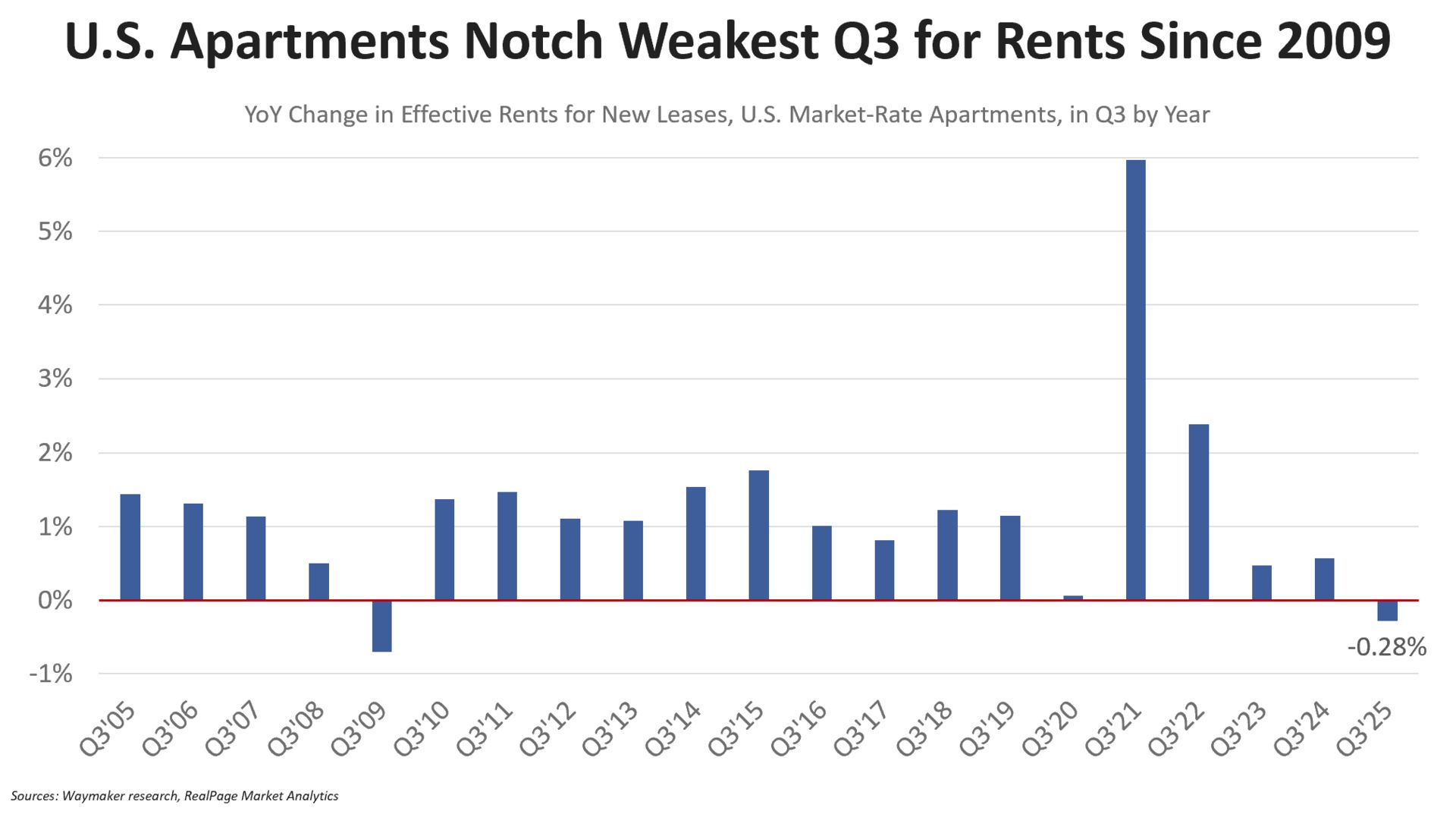

Data Viz of the Week: The First Q3 Rent Drop Since 2009

US apartments just experienced their worst Q3 since the Global Financial Crisis in 2009. Rents dropped by 0.28% Q/Q — a minor hit to P&Ls but notable for a quarter that traditionally sees increases.

But unlike in 2009, 2025’s struggles aren’t due residents’ financial distress but rather oversupply: more than 500,000 new units are set to hit the market this year after a record-setting 608,000 in 2024.

Upcoming Thesis Driven Courses & Classes

📣 LAST CALL - October 14-15: Workshop: Raising Retail Capital at Scale (💻 Online): A two-day interactive workshop for real estate sponsors, entrepreneurs, and fund managers raising capital from individual investors at scale. - Sign up

📣 LAST CALL - October 13: Bootcamp: Selling into Real Estate Owners (💻 Online): A five week bootcamp for people selling technology and products into the real estate industry - Sign up

October 20: Bootcamp: Fundamentals of Real Estate Development (💻 Online): A five week, interactive bootcamp for aspiring developers that simulates the underwriting, design and financing of a local real estate project - Sign up

October 28-29: Workshop: Capitalizing New Housing Products (💻 Online): A two-day interactive workshop for real estate sponsors, entrepreneurs, and fund managers raising capital from individual investors at scale. - Sign up

Three Articles We Loved from Last Week

It’s not easy keeping up with everything. Here are three articles we loved from the past week that you may have missed:

(WSJ) Lower Rates Are Set to Juice the Commercial-Property Market

With expectations growing for central bank easing, interest rate drops could reinvigorate CRE activity—unlocking deals, refinancing, and re-leveraging. Analysts warn the timing and magnitude of rate cuts will determine how strong the rebound is.

(The Real Deal) Condo Sellers Outnumber Buyers in Miami, Tampa

In top Florida and Texas metros, the number of condo sellers wildly overshadows buyers. For instance, in San Antonio, there were 585 sellers vs. 120 buyers—a 386% differential. The imbalance reflects cooling demand in previously heated markets.

(Reuters) US office late payments spike on New York City loan default, Fitch says

In September 2025, U.S. office loan delinquencies jumped sharply to 8.12%, fueled by a $180 million default on 261 Fifth Avenue in Manhattan. The default also dragged up CMBS office delinquencies nationwide.

Developer of the Week: Pacific Elm Properties

Uptown Dallas will have a new tallest tower thanks to Pacific Elm.

Pacific Elm Properties’ Bank of America Tower at Parkside is a big step for the firm and for Dallas’s Uptown skyline. The 30-story, 454-foot tower—developed with KDC and designed by Kohn Pedersen Fox—will be the tallest office building in Uptown and a flagship asset in Pacific Elm’s portfolio.

Anchored by Bank of America, the project exemplifies Pacific Elm’s strategy of delivering amenity-rich workplaces amid a “flight to quality” in the Dallas market. On track for a 2027 completion, the tower will be a new addition to Dallas’s skyline, but questions remain about lease-up velocity given the copious supply in the Dallas office market.

You can read more about Pacific Elm on the Thesis Driven GP database here.

Know about a developer doing something cool? Reach out to [email protected] with the tip!

Rendering of the outside of Pacific Elm’s Parkside tower

Investor of the Week: Sculptor

Sculptor Capital (formerly Och-Ziff) is one of the world’s most diversified alternative investment platforms, spanning real estate, credit, and multi-strategy funds.

Headquartered in New York, the firm manages more than $30B across global mandates and has become increasingly active in real estate and real-asset–backed credit. Its opportunistic real estate funds target complex, structured situations across property sectors—from land banking and development financing to hospitality and experiential assets.

Recent moves include a $3B raise for its fifth flagship real estate fund, its largest to date, and a €245M commitment to Therme Group, an urban wellness and leisure platform expanding across Europe. Sculptor also continues to scale its private credit arm, closing a $900M fund earlier this year and maintaining one of the most active CRE CLO platforms in the market,

Get more details on Sculptor Capital, including access to executive contacts, on the CapitalStack database here.

—Brad and Paul