- Thesis Driven

- Posts

- The Thesis Driven TL;DR | Week of October 20th

The Thesis Driven TL;DR | Week of October 20th

Everything you need to know about real estate in one little email

🗽 NYC office bounce-back is real

🤑 $730mm Midtown play… SL Green bets big on NYC office recovery

🌊 Flood insurance halt = housing market hit

📚 Workshops & courses: Development, Capital Raising and Capitalizing Niche Housing Products

Data Viz of the Week: Rates and Affordability

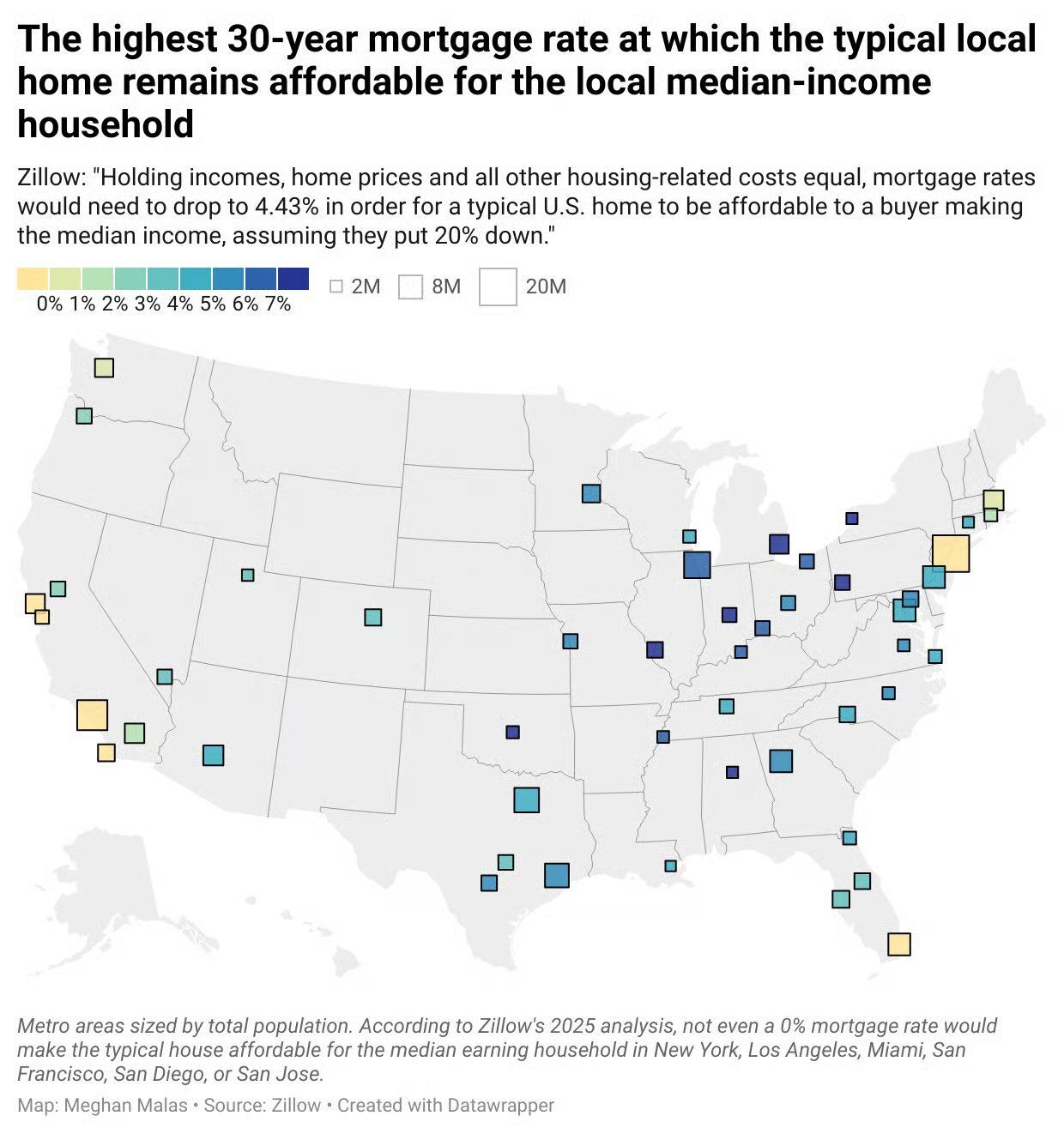

Zillow just published a new way to look at home affordability: How far would 30-year mortgage rates have to drop in your MSA for homes to be affordable to someone making the median income?

The not-so-surprising surprise? In six metros, mortgage rates would have to drop below 0% to pass this test.

(For reference, the current average 30Y rate is 6.31%)

Upcoming Thesis Driven Courses & Classes

📣 LAST CALL - October 20: Bootcamp: Fundamentals of Real Estate Development (💻 Online): A five week, interactive bootcamp for aspiring developers that simulates the underwriting, design and financing of a local real estate project - Sign up

October 27: Bootcamp: Fundamentals of Capital Raising (💻 Online): A five week, interactive bootcamp providing an insider’s guide to raising capital for real estate projects from individuals, family offices and institutional investors - Sign up

October 28-29: Workshop: Capitalizing New Housing Products (💻 Online): A two-day interactive workshop for real estate sponsors, entrepreneurs, and fund managers raising capital from individual investors at scale. - Sign up

Three Articles We Loved from Last Week

It’s not easy keeping up with everything. Here are three articles we loved from the past week that you may have missed:

(WSJ) The New York City Office Market Is Roaring Back, and It’s Pricier Than Ever

Manhattan saw 23.2 million sq ft of incremental leasing in the first nine months of 2025—outpacing national trends and even pre-pandemic figures. Top leases are being inked at over $100/sq ft, driven by finance, tech and media tenants. Vacancy still hovers around 14.8%.

(WSJ) SL Green Is Buying NYC’s Park Avenue Tower in One of the Year’s Biggest Deals

SL Green agreed to acquire the 620,000-sq-ft Park Avenue Tower (36 stories, over 95% leased) in Midtown Manhattan for $730 million, marking one of the largest office-building deals of 2025. The transaction signals renewed investor confidence in NYC’s office sector, despite broader headwinds. See below for more color on SL Green and the deal.

(Reuters) US government shutdown threatens home sales in flood-prone areas, report says

A prolonged U.S. government shutdown has halted the National Flood Insurance Program, putting at risk over 3,600 home closings per day and potentially tens of billions of dollars in transactions—particularly in flood-vulnerable areas like Florida, Virginia and North Carolina.

Developer of the Week: SL Green

SL Green's Manhattan office portfolio is growing.

The firm has agreed to acquire the Park Avenue Tower (65 East 55th Street, New York) for $730 million. The 36-story office tower is being sold by Blackstone, which bought and renovated it for an estimated $925 million investment since 2014.

The deal came in a market where discretionary office buyers are increasingly active as pricing softens. SL Green stepped in preemptively and outbid others, acting quickly once the property was listed.

Major tenants include PineBridge (occupying ~75,000 sf), BTIG, Raine Group, and a CAA division.This deal aligns with SL Green’s recent push in the office space: it has contracts to acquire the former Brooks Brothers building (to build a new office tower), has shown interest in the Chrysler Building, and was in bidding for Paramount Group assets.

You can read more about SL Green on the Thesis Driven GP database here.

Know about a developer doing something cool? Reach out to [email protected] with the tip!

Park Avenue Tower

Investor of the Week: RWN Real Estate Partners

RWN Real Estate Partners is the real estate investment arm of RWN Management, the single-family office of Apollo Global Management co-founder Marc Rowan.

Based in New York and led by Ari Shalam, the firm targets joint-venture and direct equity investments in the U.S. middle market, typically writing $5-25 million checks alongside operating partners with strong local expertise. RWN focuses on value-add, opportunistic, and special-situation deals across multifamily, industrial, hospitality, and mixed-use assets—often in secondary growth markets such as Texas, North Carolina, and Florida.

Recent activity includes recapitalizations and ground-up projects in New York and Miami, along with selective investments in Puerto Rico. Backed by long-duration family capital and an entrepreneurial mandate, RWN positions itself as a hands-on, flexible JV partner capable of structuring creative equity and preferred deals.

The platform reflects Rowan’s broader investment philosophy: combine institutional discipline with family-office agility.

Get more details on RWN, including access to executive contacts, on the CapitalStack database here.

—Brad and Paul