- Thesis Driven

- Posts

- The Thesis Driven TL;DR | Week of October 27th

The Thesis Driven TL;DR | Week of October 27th

Everything you need to know about real estate in one little email

⛓️ Blockchain’s move from hype-cycle to match-cycle in CRE

🏖️ Michael Shvo’s Miami Beach headache

🏰 Luxury hotels thrive while the rest stall

📚 Workshops & courses: Capital Raising, Capitalizing Niche Housing Products, Selling Proptech & Pitching Family Offices

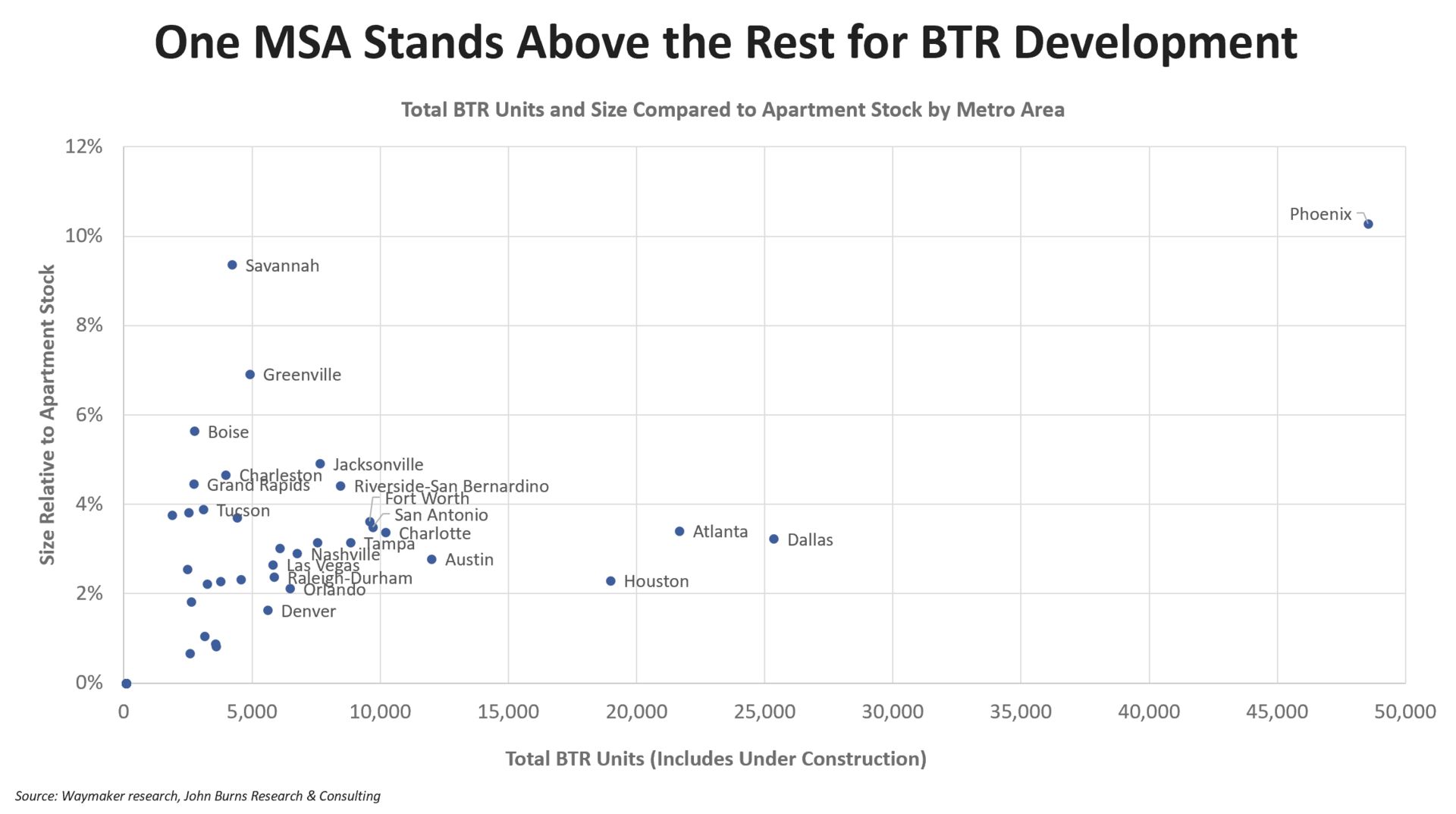

Data Viz of the Week: BTR’s Concentration

Single-family build-to-rent (BTR) is one of the hottest real estate categories out there, attracting interest from family offices, institutional investors, and more.

But the concept hasn’t expanded significantly beyond a handful of Sunbelt markets; there are only four metros with more than 15,000 BTR units, and one metro (Phoenix) has almost twice the BTR inventory as the second-place market.

The good news? BTR still has a long way to run given its low penetration in most places. The bad news? Developers haven’t gotten BTR to pencil at scale in many markets.

Upcoming Thesis Driven Courses & Classes

📣 LAST CALL - October 27: Bootcamp: Fundamentals of Capital Raising (💻 Online): A five week, interactive bootcamp providing an insider’s guide to raising capital for real estate projects from individuals, family offices and institutional investors - Sign up

📣 LAST CALL - October 28-29: Workshop: Capitalizing New Housing Products (💻 Online): A two-day interactive workshop for real estate sponsors, entrepreneurs, and fund managers raising capital from individual investors at scale. - Sign up

November 3: Bootcamp: Master Selling into Real Estate Owners (💻 Online): A five week, interactive bootcamp for people selling technology and products into the real estate industry - Sign up

November 4-5: Workshop: Raising Capital from Family Offices (💻 Online): A two-day interactive workshop designed for real estate sponsors, entrepreneurs, and capital raisers looking to raise capital from family offices. - Sign up

Three Articles We Loved from Last Week

It’s not easy keeping up with everything. Here are three articles we loved from the past week that you may have missed:

(MSNBC) Commercial real estate is finally embracing blockchain

The commercial-real-estate sector, long resistant to tech disruption, is increasingly using blockchain for things like fractional ownership, tokenized real-world assets and smarter transaction workflows. The article highlights pilots, regulatory scrutiny and how investors are beginning to view the tech as more than hype.

(The Real Deal) Breakdown of What Went Wrong for Michael Shvo in Miami Beach

Shvo purchased the iconic three-hotel Raleigh assemblage in Miami Beach in 2019 for around $243 million, planning a luxury condo‐hotel project with pricing up to $12,000 per sq ft. Two years later, he sold the site to Nahla Capital for $270 million after presales lagged, the Cheval Blanc deal collapsed, and the brokerage hired to market the units was embroiled in scandal. Market softness, capital-market challenges and execution missteps all played a role.

(Yahoo Finance) A Tale of Two U.S. Markets: Affluent Travelers Lift Luxury Hotels as Others Falter

he U.S. hotel market is dividing sharply: luxury and upscale properties—especially those serving affluent travelers—are outperforming, while mid-scale and economy segments struggle with lower occupancy and softer demand. The divergence reflects shifting consumer behavior, travel patterns, and investment focus toward high-end stays.

Developer of the Week: Presidio Bay Ventures

You know offices. You know resorts. But do you know the "office resort"?

Presidio Bay Ventures is redeveloping 88 Spear Street in San Francisco into The Spear, a 13-story, 184,000-square-foot “office resort” emphasizing hospitality and wellness.

Acquired for $40.9 million in 2023, the project adds coworking firm CANOPY and Arsicault Bakery as its first tenants. Amenities include a rooftop bar, spa-style fitness center, golf simulator, and wellness lab.

Operated by Presidio Bay’s platform The Main Post, the project reflects founder Cyrus Sanandaji’s vision to reimagine the workplace as a high-end lifestyle experience. Presidio Bay’s $5.6B portfolio includes Springline in Menlo Park and Ventana Residences in San Francisco.

You can read more about Presidio Bay Ventures on the Thesis Driven GP database here.

Know about a developer doing something cool? Reach out to [email protected] with the tip!

Park Avenue Tower

Investor of the Week: CapRidge Partners

CapRidge Partners is an Austin-based private real estate investment manager focused on value-add office and mixed-use properties in high-growth U.S. markets.

Founded in 2012 by industry veteran Tom Stacy, the firm targets mid-market assets in nine of America’s fastest-growing cities—markets like Austin, Charlotte, Denver, Nashville, and Raleigh—where demographic and employment trends continue to support tenant demand. CapRidge combines in-house operations, leasing, and property management to execute physical and operational improvements, driving NOI growth and re-tenanting under-loved suburban and infill offices.

Rather than chasing trophy assets, CapRidge thrives in the “fixable middle,” acquiring buildings with strong bones and overlooked potential—often suburban offices that can be repositioned into vibrant, amenity-rich environments. With more than $2B in AUM and a deep bench of institutional LPs, the firm represents a new class of operationally focused, regionally specialized value-add managers betting that office isn’t dead—it’s just being reinvented.

Get more details on CapRidge Partners, including access to executive contacts, on the CapitalStack database here.

—Brad and Paul